Subscribe to our newsletter

Net Operating Income (NOI) is a metric that measures the profitability of a rental property. It is calculated by subtracting all operating expenses from the total revenue generated by the property. A higher NOI indicates greater profitability, achieved by maximizing revenue and minimizing costs.

Familiarizing yourself with the NOI calculation can be the difference between languishing as an investor who never realizes their potential and becoming one who consistently identifies revenue-generating propertiesthat make a profit for stakeholders.

Knowledge of NOI allows you and your investment partners to make informed decisions, assess risks, and unlock the true potential of an income-producing property. Lenders, meanwhile, rely on NOI to assess the potential profitability of a property when they evaluate loan applications.

Whether you’re a novice or a seasoned professional, understanding NOI can significantly impact your real estate investment strategy. It’s a must-know for everyone in the industry.

How to calculate NOI

Getting your head around the NOI calculation doesn’t require advanced math skills. It's a straightforward process of adding rental income and other revenue and subtracting operating expenses. The resulting number is your property’s Net Operating Income.

Let’s take a closer look at the two critical components of Net Operating Income:

Gross Rental Income (GRI)

Gross Rental Income is all the revenue generated from renting out units or spaces within the property. This includes rent payments from residents and other income from amenities such as:

Parking fees

Laundry facilities

Storage rentals

Amenity fees and reservations

Vending machines

Operating expenses

Operating Expenses are all the costs associated with operating and maintaining the property. These are the expenses necessary to generate revenue and keep the property attractive to residents and prospects. It’s important to note that operating expenses do not include capital expenditures such as a new HVAC unit, a new roof, or property renovations.

Common operating expenses include:

Property taxes: The local government collects these taxes based on the property's assessed value.

Insurance: Property owners pay premiums to insure the property against risks such as fire, liability, theft, and natural disaster.

Utilities: Any utility costs the residents are not responsible for are operating expenses. These costs may include electricity, water, gas, sewer, and other utility services provided to the property.

Maintenance and repairs: Upkeep, repairs, and routine maintenance are necessary expenses to keep the property in good condition.

Property management fees: Expenditures for the property management company’s services in managing the property.

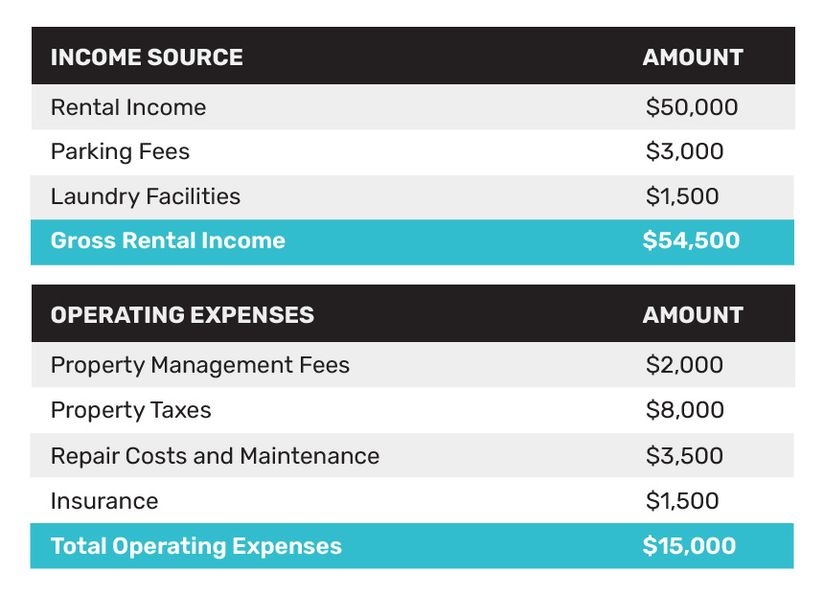

Let’s suppose the information below is a snapshot of a particular apartment community that an owner is leasing, showing gross rental income and operating expenses:

Applying the NOI formula:

Gross Rental Income - Total Operating Expenses = NOI

$54,500 - $15,000 = $39,500

How NOI informs investment choices

NOI isn’t merely a metric—it's a practical tool. It's a reliable way for real estate investors to measure a rental property's efficiency and potential profitability. It provides a standard benchmark for comparing investment opportunities, regardless of financing terms or tax implications.

When investors grasp the significance of NOI, they gain a competitive edge in the real estate market. They can make wise investment choices, enhance their portfolios, and ultimately secure long-term financial gains .

NOI is essential to gauge a rental property’s profitability because it provides insights into the property’s financial performance, evaluation, and investment potential. When investors, lenders, and property managers diligently calculate and analyze NOI, they can make informed decisions that mitigate risks and maximize return.

Here are some of the vital tasks NOI helps real estate professionals perform:

Profitability assessment: NOI indicates a property’s profitability by conveying the difference between its revenue and operating expenses. With that number, investors and property owners can better determine the property’s potential return on investment (ROI).

Property valuation: NOI also plays an integral part in determining the market value of income-producing properties. Commercial real estate investors often use the capitalization rate (cap rate) to estimate property value based on NOI. A higher NOI usually means a higher property value.

Investment comparison: When investors are considering several properties within the same market or asset class, analyzing NOI allows them to compare the properties’ financial performance, assess risk levels, and make the best decisions about where to invest their capital.

Lending considerations: When underwriting loans, lenders must evaluate income-producing properties' financial health and risk factors. A strong NOI aids in this process by demonstrating to lenders that the property can generate sufficient income to cover debt-service obligations.

Budgeting and planning: Property managers and owners rely on NOI for budgeting and financial planning. With a working knowledge of the property’s operating income and expenses, they can develop realistic budgets and allocate resources effectively.

The relationship between NOI and property value

The Net Operating Income of an investment property is directly correlated to its valuation. As the NOI of a property increases, its value generally follows. Therefore, NOI serves as a key metric of property valuation and is closely linked to the overall financial performance and marketability of income-producing properties.

The following are four examples of how NOI influences property value:

Direct impact on property value

When using the income-capitalization approach, NOI directly affects property value. According to this approach, the value of a property is reached by dividing the property’s NOI by the capitalization rate (cap rate). The cap rate is the rate of return investors expect to receive on their investments.

So the formula looks like this: Property Value = NOI / Cap Rate.

Assuming a constant cap rate, as NOI increases, property value also increases. Conversely, a decrease in NOI would lead to a reduction in property value.The market’s perception

Properties with a high NOI represent more significant income-generating potential and lower risk, so investors and lenders view them more favorably.

These properties are also seen as more stable and attractive investment opportunities, pulling in investors and commanding higher selling prices.

Better financing options become more plentiful for investors who buy income-producing properties with high NOI. Lenders are more inclined to offer these investors the lowest rates and best terms.Indicator of an efficient operation and property management

Income-producing properties with a higher NOI usually indicate operational efficiency and management effectiveness . Properties with a high NOI relative to operating expenses reflect a well-managed and cost-effective operation.

An effective management team that diligently keeps expenses down and maximizes rental income contributes to high NOI and higher property value.Market conditions and investor expectations.

Supply and demand, economic trends, investor sentiment, and other market conditions can also affect the relationship between NOI and property value.

Where high competition in the market meets high demand, investors may be willing to pay a premium for high NOI properties, driving up property prices.

The opposite is true in a down market with lower demand and unfavorable financial conditions. Properties with a low NOI may experience a drop in their property values.

Bottom line

Net Operating Income is a fundamental indicator of income-producing properties' financial health, profitability, and value. It gauges whether a rental property has the potential for positive cash flow and illuminates its performance and profitability.

Understanding how NOI influences investment transactions is crucial for making informed decisions, determining property value, and ensuring a successful investment outcome.

Key takeaways

NOI is a critical financial metric used to assess the profitability and value of income-producing properties.

It represents the income generated by a property after deducting operating expenses.

When the income capitalization approach is applied, NOI directly influences property value, where property value is determined by dividing NOI by the cap rate.

Rental properties with a higher NOI are understood to have more value and to be more attractive to investors.

NOI reflects the property’s operating efficiency, management effectiveness, and investment potential.

The importance of NOI

Real estate investors, appraisers, lenders, and property managers understand the significance of NOI when evaluating investment opportunities, assessing risk, and making informed decisions.

NOI is foundational when comparing properties, analyzing market trends, and identifying lucrative investment opportunities.

Factors that influence NOI

Various factors influence NOI, such as rental income, operating expenses, property management efficiency, market conditions, and investor expectations.

An efficient and competent property management team that initiates cost-saving practices and revenue-optimizing strategies can positively impact NOI and increase property worth.

Considering these things and implementing them will increase your property’s NOI and its value.

At SmartRent, our team of professionals offers access control software and hardware solutions designed to enhance security, streamline operations, and maximize the value of your properties.

With SmartRent's access control software, you can gain valuable insights into your property's financial performance. Streamline operations, reduce operating expenses, and maximize NOI, ensuring a healthy bottom line for your investments.

We’re here to help and support your efforts to unlock your full potential. Contact us today to schedule a demo and discover how we can help you achieve your property management goals.