Subscribe to our newsletter

Key Takeaways

Renter mobility is accelerating: Driven by affordability, lifestyle shifts and job market dynamics, renters are increasingly relocating, creating both opportunities and challenges for multifamily operators.

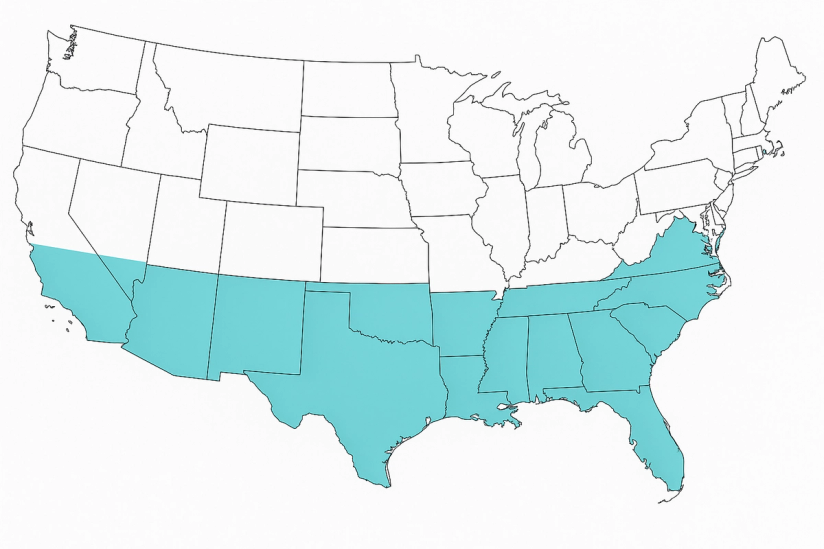

Migration trends are clear: Expect continued growth in Sun Belt and suburban markets (e.g., Phoenix, Tampa, Raleigh, Nashville), while some urban cores may see softening demand (e.g., parts of Bay Area, Chicago, Northeast).

Strategic adaptation is crucial: Operators in high-growth markets should leverage automation for scaling and efficient lease-ups, while those in slower markets should prioritize retention, value-add upgrades and differentiated experiences.

Technology is essential for agility: Integrated smart technology platforms empower operators to adapt to shifting demand, enhance resident experiences and maintain operational efficiency in any market condition.

SmartRent enables competitiveness: By providing tools for automated leasing, smart access, resident retention and data-driven insights, SmartRent helps operators navigate market changes, accelerate growth and optimize portfolios for 2025 and beyond.

Renters are on the move, and multifamily operators need a plan.

From remote work flexibility to housing affordability and lifestyle preferences, Americans are increasingly open to relocating. This internal migration is already influencing leasing activity across the country, with some metros experiencing explosive demand while others face slower growth.

The good news? These shifts follow clear patterns. They’re trackable, actionable and—when approached strategically—entirely manageable. Whether your portfolio includes high-growth metros or maturing urban cores, this is the moment to rethink your playbook.

The 2025 resident migration snapshot

Several metros continue to outpace the rest in net new lease activity—particularly in the Sun Belt and fast-growing suburban areas. Markets like Phoenix, Tampa, Raleigh and Nashville are consistently seeing demand spikes, thanks to a mix of job creation, new housing supply and lifestyle appeal.

Meanwhile, leasing activity is softening in parts of the Bay Area, Chicago and the Northeast, especially in downtown cores still adjusting to lower return-to-office rates.

Key migration trends include:

Migration from high-cost to lower-cost metros

Suburban leasing growth near major urban centers

Build-to-rent (BTR) and single-family rental (SFR) expansion in states like Arizona, Texas and Florida

These shifts are backed by data from sources like the U.S. Census Bureau, Yardi Matrix, U-Haul’s Growth Index and Moody’s Analytics—all pointing to a continued reshaping of where renters choose to live.

What’s driving the shift?

Multiple factors are accelerating resident mobility:

Economic opportunity: Job growth is surging in Sun Belt metros, tech corridors and healthcare hubs.

Affordability: With single-family home prices still out of reach for many, multifamily communities remain an accessible option, especially for younger families.

Lifestyle: Remote-friendly cities with warmer climates continue to attract residents prioritizing quality of life over legacy zip codes.

New supply: Developers are actively meeting this demand with BTR and new multifamily stock in high-growth regions.

As one expert recently noted in SmartRent’s Market Shifts 2025 webinar, “Renters are choosing lifestyle and affordability over legacy zip codes.”

Strategies for high-growth markets

If you’re operating in a high-demand metro, the challenge isn’t attracting interest—it’s keeping pace.

Key strategies include:

Leaning into automation: Centralized leasing tools, smart access and self-guided tours reduce the need for excessive staffing as volume rises.

Marketing for lifestyle: Highlight smart home tech, remote-work-friendly spaces and on-demand amenities that speak to modern renters.

Staying price agile: Dynamic pricing strategies can help you stay competitive as supply increases and comps shift.

Scaling without burnout: Use virtual tours and centralized communication hubs to avoid overwhelming on-site teams.

In competitive markets, renters often tour multiple properties in a short window. Communities that offer convenient, tech-enabled leasing experiences, such as instant scheduling, mobile entry and on-demand tours, are better positioned to convert interest into signed leases. These features don’t just reduce friction; they enhance brand perception and reflect a commitment to resident convenience.

Operators in fast-growing cities like Phoenix and Austin are using SmartRent’s smart access and self-guided tour solutions to accelerate lease-ups and maintain occupancy velocity—without sacrificing the resident experience. These features reduce friction, improve brand perception and allow communities to convert high-intent renters faster.

Strategies for slower-growth or cooling markets

Markets seeing softening demand shouldn’t panic, but they should pivot.

Consider the following:

Focus on retention: Technology-driven convenience, fast maintenance response and personalized service help keep current residents happy.

Add value through upgrades: Smart locks, energy-saving thermostats and bundled services can boost perceived value without raising rent significantly.

Differentiate through experience: Emphasize community-building and offer more personalized touches that foster long-term satisfaction.

Reach overlooked renters: Retirees, lifestyle-driven movers and remote workers often seek stable, well-managed communities in these areas.

Retention is more than a fallback strategy, it’s a growth strategy in maturing markets. For example, some operators are using resident portals to offer digital concierge services, host virtual events or manage referrals, all of which strengthen the resident relationship and reduce turnover.

Why tech matters in a mobile rental market

No matter the market trajectory, technology is the great equalizer.

Integrated platforms give operators the flexibility to scale up or optimize without adding complexity. Smart home tools, automated leasing workflows and centralized dashboards help deliver consistency and responsiveness—two things every renter wants, regardless of geography.

In an environment where residents are constantly reevaluating their zip codes, operational agility isn’t optional, it’s essential. With the right technology stack, properties can adapt to shifting demand and provide standout service wherever renters land.

How SmartRent can help

The U.S. rental landscape is shifting rapidly, but with the right data, strategy and tools, multifamily operators can stay ahead of the curve.

Understanding migration trends is just the beginning. The real differentiator lies in how you respond—whether that’s accelerating lease-ups, strengthening retention or improving efficiency across your portfolio. With SmartRent, operators don’t have to choose between resident experience and operational control. You can have both.

Ready to future-proof your operations? Schedule a demo today to get started.